The Tenant, Homeowner and Small Landlord Relief and Stabilization Act of 2020 or “Tenant Relief Act” and the “Tenant Relief Act Extension of 2021” provides relief and assistance for tenants and landlords struggling financially due to the pandemic through June 30, 2021. The original extension also created a new State Rental Assistance Program and $2.6 billion in federal rental assistance available statewide. Current actions under AB 832 will extend the deadline to September 30, 2021, brings the total amount of monies available for rent relief to $5.2 billion, and gives tenants, homeowners and landlords time to come to agreements and make use of the funding available.

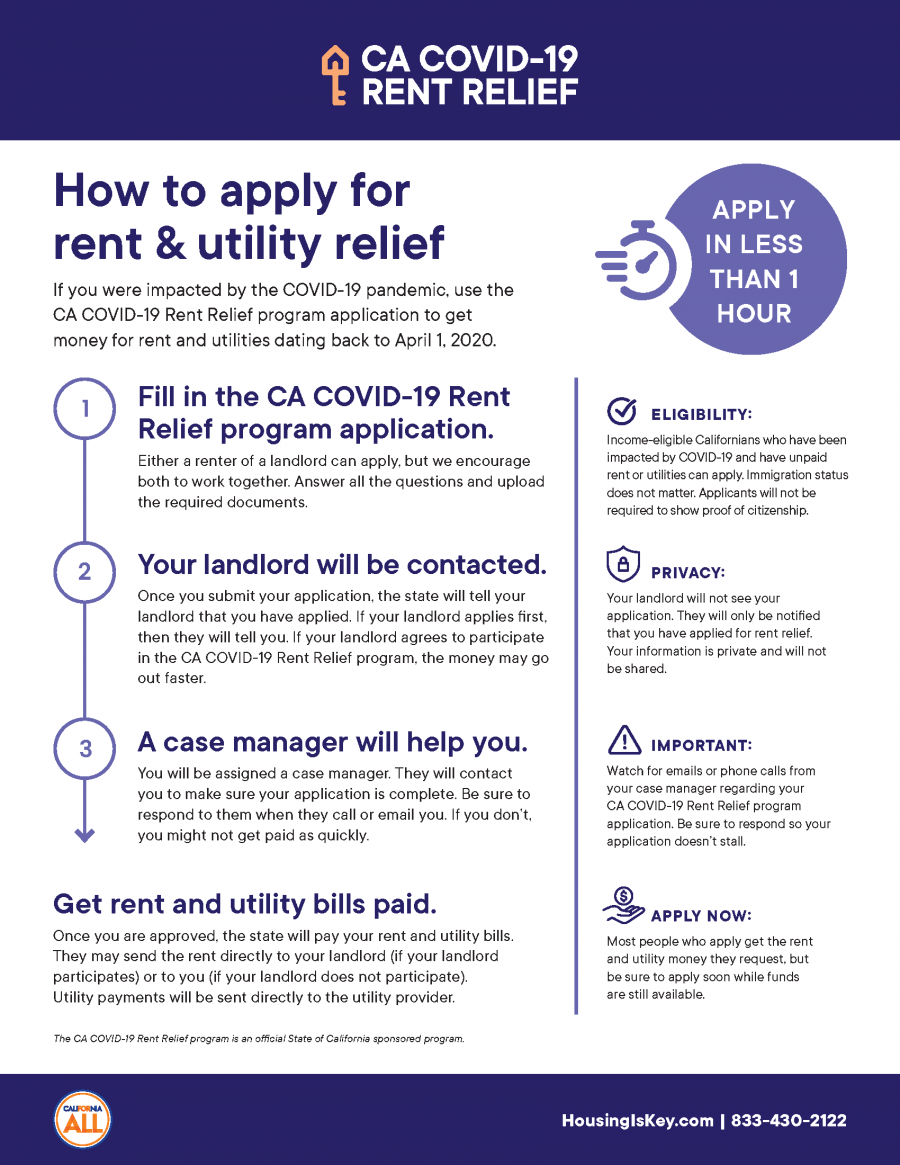

Additional steps will offer significantly stronger incentives for landlords to utilize these funds, as well as protections for tenants. Either a tenant or a landlord may initiate the process for rental assistance. Visit HousingIsKey.com or call 1-833-422-4255 to learn more.

The COVID-19 pandemic has created serious hardships for both tenants and landlords, alike. That's why I began the year by calling for $5 Billion in rent relief. Governor Newsom's signature of AB 832 effectively allows for the debt carried by most tenants and landlords to be paid by the state. All of it. If a tenant makes less than 80 percent of median income, they or their landlord can apply to receive 100 percent of unpaid rent. Tenants can receive the full amount, even if their landlord does not participate in the application process.

In addition, the non-payment eviction moratorium is now extended until September 30, 2021. After September 30, a tenant still cannot be evicted for non-payment if they pay at least 25 percent of their rent between September 1, 2020 and September 30, 2021. Starting October 1, 2021 tenants should be preparing to pay 100% of their rent unless there are additional protections in place in their city or county of residence. If a landlord tries to evict a tenant after September 30, that landlord must first show that they applies for rental assistance and that the application was denied. The court cannot allow an eviction case to be filed if a pending rent relief application exists.

That said, rent relief payments going to landlords do not come with any strings attached. Landlords are not bound to any additional rules and regulations beyond California's civil code and local ordinances when it comes to repairs, rent increases, etc. If a landlord issues a 15-day pay or quit notice, tenants must send a declaration of financial hardship within those 15 days and seek legal support. Here is the California Attorney General's guide to tenant-landlord disputes. Here is the Housing Is Key Tenants Resources Guide.

- Received $2.65 Billion from the Federal Government so far.

- California is eligible to receive an additional $1.1 billion in funds as well as an additional $26 million from the high-need grantee set-aside, totaling over $1.2 billion.

- Local governments are eligible to receive direct allocations from the Treasury, totaling $880 million plus an additional $494 million from a “high-need” grantee set-aside.

- Treasury will distribute Round 2 funds in portions. Treasury will first distribute 40% of a grantee’s total allocation, subsequent allocations will be made once 75% of the first portion is obligated. Both direct allocations and the high-need set aside follow this same allocation structure in Round 2.

- Pays up to a year of unpaid back rent (from April 2020) and allows up to three months of future rent payments depending on availability of funds.

- Prioritizes households with highest need, targeting households with less than 80% area median income (AMI) with special focus on households below 50% AMI and households experiencing unemployment for at least 90 days.

- Any unused funds will be redirected to areas of highest needs.

- California is eligible to receive an additional $1.1 billion in funds as well as an additional $26 million from the high-need grantee set-aside, totaling over $1.2 billion.

- Either a tenant or a landlord may initiate the assistance process.

- Offers participating landlords 100% of a tenant’s remaining back rent owed. Landlord can be “topped up” if they’d already been paid under the previous arrangement.

- Pays 100% of back rent owed if the landlord declines to participate. Tenant can be “topped up” if they’d already been paid under the previous arrangement. Tenant must pay landlord with in 15 days of receiving the funds or face penalties.

- Authorize payment eligibility for landlords if a tenant has already departed premises, but still owes rent (arrears).

- Provides 100% of prospective rental payments after accounting for unpaid back rent up to 3 months.

- Beginning October 1, 2021, creates a process to ensure that rental assistance is sought by landlord prior to the filing of an unlawful detainer.

- Includes a process that prevents a court from issuing a summons if the landlord cannot prove they attempted to apply for rental assistance and that either the tenant didn't qualify or the program ran out of money.

- Requires a tenant to fill out the necessary paperwork for the rental assistance program within 15 days of the landlord filling out their portion if a landlord has served the tenant with a three-day notice to evict.

- Requires rental assistance programs to create a pre-screening process to allow landlords to easily find out if the tenant meets income requirements to benefit from the program.

- Extends current eviction moratorium to September 30, 2021 and makes corresponding date changes in other sections.

- Increases rental assistance payments to give 100% of rent owed for eligible landlords and tenants.

- Allows a tenant to receive full amount due if the landlord doesn’t participate in the program so that they are not carrying it as consumer debt.

- Creates a process to ensure that from October 1, 2021 through March 31, 2022, struggling tenants impacted by COVID-19 will still be protected under state law.

- Permanently “masks” (meaning the information remains confidential in the court process) unlawful detainer (eviction) cases related to COVID rental debt, thus protecting tenants from having unpaid rental debt due to COVID held against them when they seek future housing.

- Permanently masks COVID rental debt civil cases, thus protecting tenants from having these cases impact their consumer credit.

- Increases rental assistance payments to give 100% of rent owed for eligible landlords and tenants.

- Allows a longer timeframe for rental assistance funds, so more unpaid rent can be covered. Matching updated federal rules, rental assistance can apply to any rent debt accrued on or after April 1, 2020.

- Authorizes rental assistance payments to be provided to landlords in situations where the tenant has moved out and now lives in a new place, but still owes rent payments to their prior landlord.

- Requires a tenant to fill out the necessary paperwork for the rental assistance program within 15 business days of receiving notice of their landlord filling out its portion when a three-day eviction notice has been served.

- Beginning October 1, requires rental assistance programs to create a pre-screening process to allow landlords and tenants to easily find out if the tenant meets income requirements (household income < 80% AMI). If a tenant doesn’t qualify for the rental assistance program or refuses to participate the program, or program funds have been exhausted, the landlord would be allowed to continue with the eviction process.

- These eviction protections do not apply to new tenancies beginning on or after October 1, 2021.